carried interest tax changes

Under Bidens proposal fund managers might change valuation. Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the Internal Revenue Code of 1986 as amended the Code.

Service Datasheet Seychelles Offshore Company Ico Services By Ico Services Via Slideshare Offshorebankingbusiness Offshore Offshore Bank Banking

The carried interest tax break for private equity and venture capital firms is once again in the spotlight and founders could feel the results.

. Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be. The managers pay a federal personal income tax on these gains at a rate of 238 percent 20. Annual management fees are taxed as ordinary income currently subject to a top tax rate of 37.

Senate Finance Committee Chairman Ron Wyden D-OR and committee member Senator Sheldon Whitehouse D-RI re-introduced legislation to change the taxation of carried interestthe Ending the Carried Interest Loophole Act. The Inland Revenue Amendment Tax Concessions for Carried Interest Bill 2021 passed its third reading in the Legislative Council unamended and once published in the official gazette will become law. The Biden Administration has also included a provision to eliminate capital gains treatment for carried interests in its American Families Plan presented to Congress on May 28 2021.

Many PE funds considered converting to C corporations after TCJA lowered the corporate rate to 21 since the corporate form has other advantages including. Modifying the limitation on deduction of business interest expense The bill would amend Section 163j to apply the interest limitation at the partner level instead of at the partnership level as under current law effective for tax years beginning after December 31 2021. 115-97 modified the taxation of carried interests by enacting Sec.

Assuming a 2x return on a 10MM fund versus a 1 Billion fund a 20 carried interest is 2MM versus 200MM respectively. The preferential tax rate is especially important for a private equity fund and its managers. It made sense for PE firms to operate as partnerships when the corporate tax rate was 35 and there was a lower tax rate on capital gains that also applied to the fund managers carried interest.

Final carried interest regulations are expected to be released by year-end and will include significant changes to the proposed regs released over. Tax incentives include 0 tax rate for carried interest. Some view this tax treatment as unfair because the general partner.

Carried interest is generally taxable as capital gains in the UK - albeit since 2015 at higher rates than other capital gains and at income. This tax information and impact note deals with changes to the carried interest rules for Capital Gains. However carried interest is often treated as long-term capital gains for tax purposes subject to a top tax rate of 238 20 on net capital gains plus the 38 net investment income tax.

The law known as the Tax Cuts and Jobs Act PL. The 17 tax differential. Clearly not all carried interest is the same.

Tax systems are generally deemed to be more efficient when they tax similar activities in a like manner. The law known as the Tax Cuts and Jobs Act PL. While proposed transition rules would permit a 20 percent tax.

These regulations became final five months later in January 2021. Arguments to change the tax treatment of carried interest are often based on the economic principles of efficiency and equity. Every president since George W.

Capital Gains Tax. 1068 The Carried Interest Fairness Act of 2021 has been introduced in Congress to eliminate capital gains tax treatment for carried interests. The regulations addressed many outstanding issues and provided much needed clarity.

Despite this change HR. According to a press release issued by the Finance Committee in conjunction with the bills introduction the proposed. The carried interest changes would apply to tax years beginning after December 31 2021.

The final regulations retain the basic structure of the proposed regulations with certain changes made in response to comments. Capital Gains Tax Changes Raises 1234 billion. Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie.

A private equity fund typically uses carried interest to pass through a share of its net capital gains to its general partner which in turn passes the gains on to the investment managers figure 1. If the carried interest tax loophole is closed private equity and hedge fund managers might take actions that could draw SEC scrutiny. A carried interest is a form of profits interest that gives a service provider the right to share in future partnership profits but is not taxable upon receipt because it.

Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest continues. 115-97 extended the holding period for certain carried interests applicable partnership interests APIs to three years to be eligible for capital gain treatment. In August 2020 the IRS published proposed regulations in the Federal Register to implement the carried interest tax changes brought about by the TCJA.

In January 2021 the US. This Code provision generally says that to qualify for tax-favored long-term capital gains LTCGs treatment certain carried interest arrangements must meet a greater-than-three-year holding period. The House Ways and Means Committee measure would increase the capital gains tax rate from 20 percent to 25 percent and the total top capital gains tax rate to 288 percent when combined with proposal below.

The legislation is the culmination of an. Posted in Featured Q3 2021 Issue. Capital Gains and Carried Interest.

US Chamber of Commerce report predicts tax changes could see the PEVC industry shrink by nearly 20 percent A US Chamber of Commerce study predicts dire consequences if tax on carried interest is increased by 98 percent the effective outcome of carry being taxed as income Private Funds CFO reported.

Accounting Taxation Income Tax Deductions Lic Donation Mediclaim Pension Fund Home Loan Repayment Bank Fdr Etc Ca Income Tax Tax Deductions Tax Refund

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Doing Business In The United States Federal Tax Issues Pwc

Pin On Irs Tax Debt Relief Tax Settlement

The Sec 1061 Capital Interest Exception And Its Impact On Hedge Funds

Pin By Mustakeem Mandal On Id Puruf Saving Bank Account Savings Bank Bank Account

Wow Filing Late Return Can Save Tax Too Http Taxworry Com Section 54 54f Filing Late Return For Extending Period Of Inve Investing Capital Gains Tax Taxact

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Kilcoyne Accountants Has Experienced Tax Accountants And Financial Advisors Business Tax Tax Services Tax Accountant

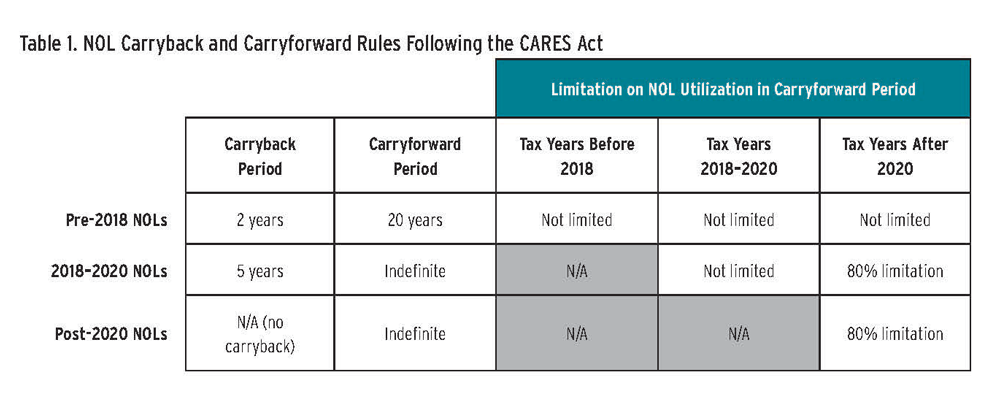

Nol Carrybacks Under The Cares Act Tax Executive

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Internal Vs External Audit Accounting And Finance Internal Audit Risk Management

In 2011 Convey Sponsored A Tax And Regulatory Survey Carried Out By The Institute Of Financial Operations During A Time Of U Tax Infographic Accounts Payable

Signs Your Business Might Qualify For R D Tax Credits Income Tax Tax Deadline Budgeting Money

Carried Interest Plans Can Benefit Both The Fund Management Industry And Investors Intertrust Group

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)